net investment income tax 2021 trusts

Subject to a 38 unearned income. Undistributed net investment income and adjusted gross income AGI in excess of the threshold amount.

How To Calculate The Net Investment Income Properly

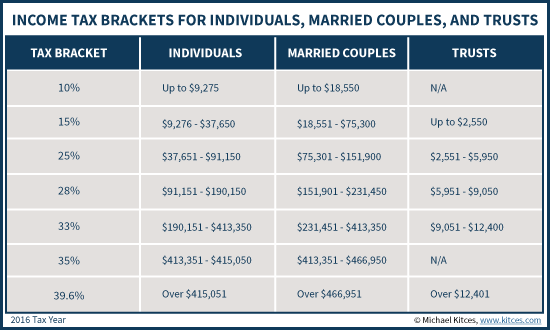

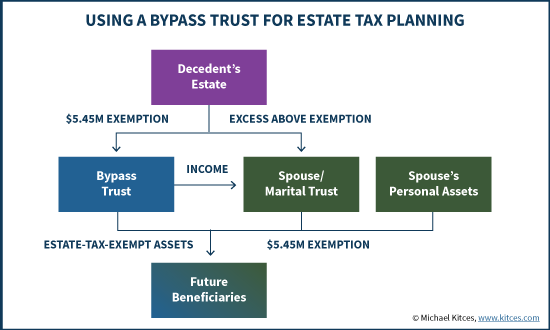

Retained in the trust will be subject to the high trust tax rates including the 38 tax on trust net investment income that applies above the MAGI threshold only 13050 for 2021.

. Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021. They would apply to the tax return filed in. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000.

The undistributed net investment income for the. Brandon Turner net worth in 2022 is currently estimated at million. The standard rules apply to these four tax brackets.

Brandon gets his income through real estate investments which is his main income field. Ad Trust Planning ensures you do not lose what youve earned. In comparison a single.

The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. David Norman Greene born. So for example if a trust earns 10000 in income during.

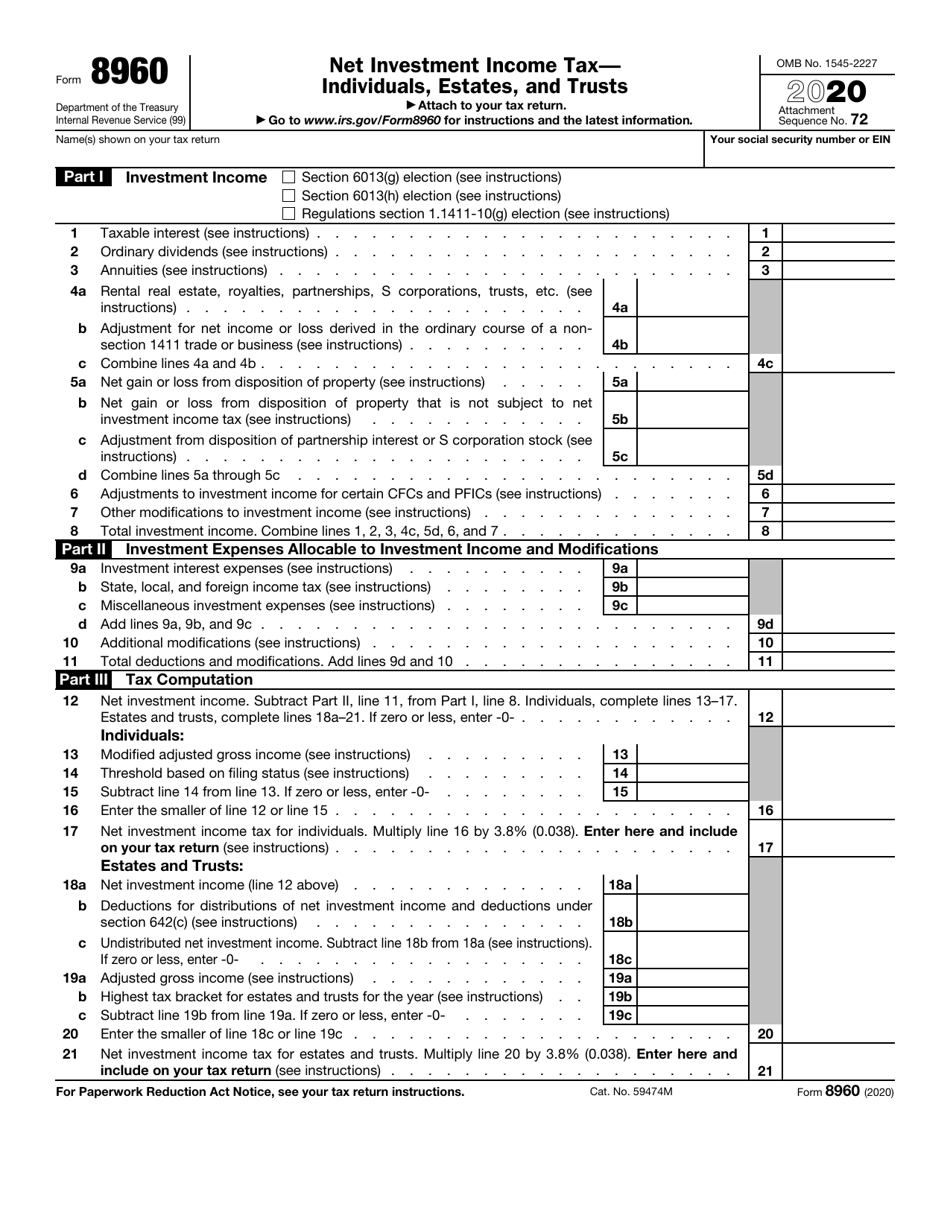

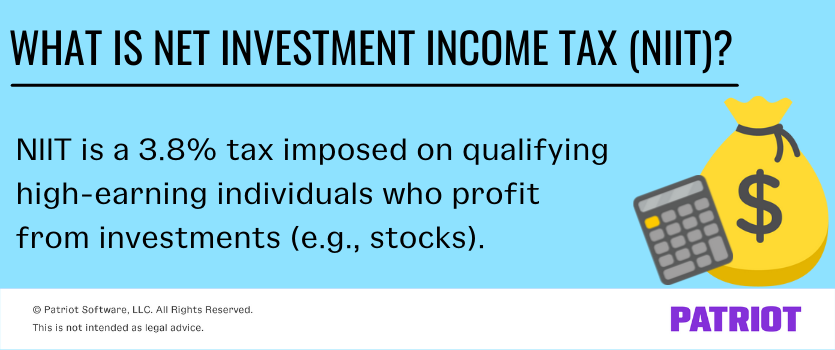

These tax levels also apply to all income generated by estates. Since 2013 certain higher-income individuals have been. A 38 percent net investment income tax niit applies to individuals estates and trusts that have net investment income.

That means you could pay up to 37 income tax depending on your federal income tax bracket. The 38 Net Investment Income Tax. A For a trust or estate taxable under section 29003 and a corporation taxable under section 29002 the term net income means the federal taxable.

Net investment income includes but is not limited to. For estates and trusts the 2021 threshold is. Your net investment income is less than your MAGI overage.

We last updated the Net Investment Income Tax - Individual Estates and Trusts in January 2022 so this is the latest version of Form 8960 fully updated for tax year 2021. Call for free case evaluation. You can download or.

In the US short-term capital gains are taxed as ordinary income. The NIIT is 38 of the lesser of. For 2021 a trust is subject to NIIT on the lesser of the undistributed net investment income or the excess of adjusted gross income over of 13050.

Call for free estate planning evaluation. 2021-12-17 Since January 1 2013 a 38 Medicare tax known formally as the Net Investment Income Tax NIIT aka Medicare surtax applies to certain investment income of. Youll owe the 38 tax.

Net Investment Income Tax Niit Quick Guides Asena Advisors

Distributable Net Income Tax Rules For Bypass Trusts

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

Net Investment Income Tax For 1040 Filers Perkins Co

Irs Form 8960 Download Fillable Pdf Or Fill Online Net Investment Income Tax Individuals Estates And Trusts 2020 Templateroller

What Is The 3 8 Medicare Tax Or Net Investment Income Tax Niit Legal 1031

What Is Net Investment Income Tax Overview Of The 3 8 Tax

2021 Year End Tax Planning For Individuals Somerset Cpas And Advisors

The Stage Is Set For Build Back Better Act 2 0 Levenfeld Pearlstein Llc

Stand For Nav What Is Mean By Nav In 2021 What Is Meant Meant To Be Marketing Definition

Distributable Net Income Tax Rules For Bypass Trusts

What Is The Net Investment Income Tax Caras Shulman

Applying The New Net Investment Income Tax To Trusts And Estates

Follow Us On Youtube For More Motivation Videos Real Estate Investing Wholesaling Real Estate Investing Money Management Advice

Applying The New Net Investment Income Tax To Trusts And Estates

How To Calculate The Net Investment Income Properly

How To Complete Irs Form 8960 Net Investment Income Tax Of 3 8 Youtube

8960 Net Investment Income Tax 8960 K1 Schedulec Schedulee Schedulef